November 11, 2022

Canlan Reports Q3 2022 Results

Canlan Reports a 23% Increase in Q3 Operating Revenue, Resumes and

Increases Dividend

Burnaby, B.C., November 10, 2022 – Canlan Ice Sports Corp. (the “Corporation”) (TSX: ICE)

today reported its financial results for the third quarter ended September 30, 2022.

Overview – Quarter Ended September 30, 2022

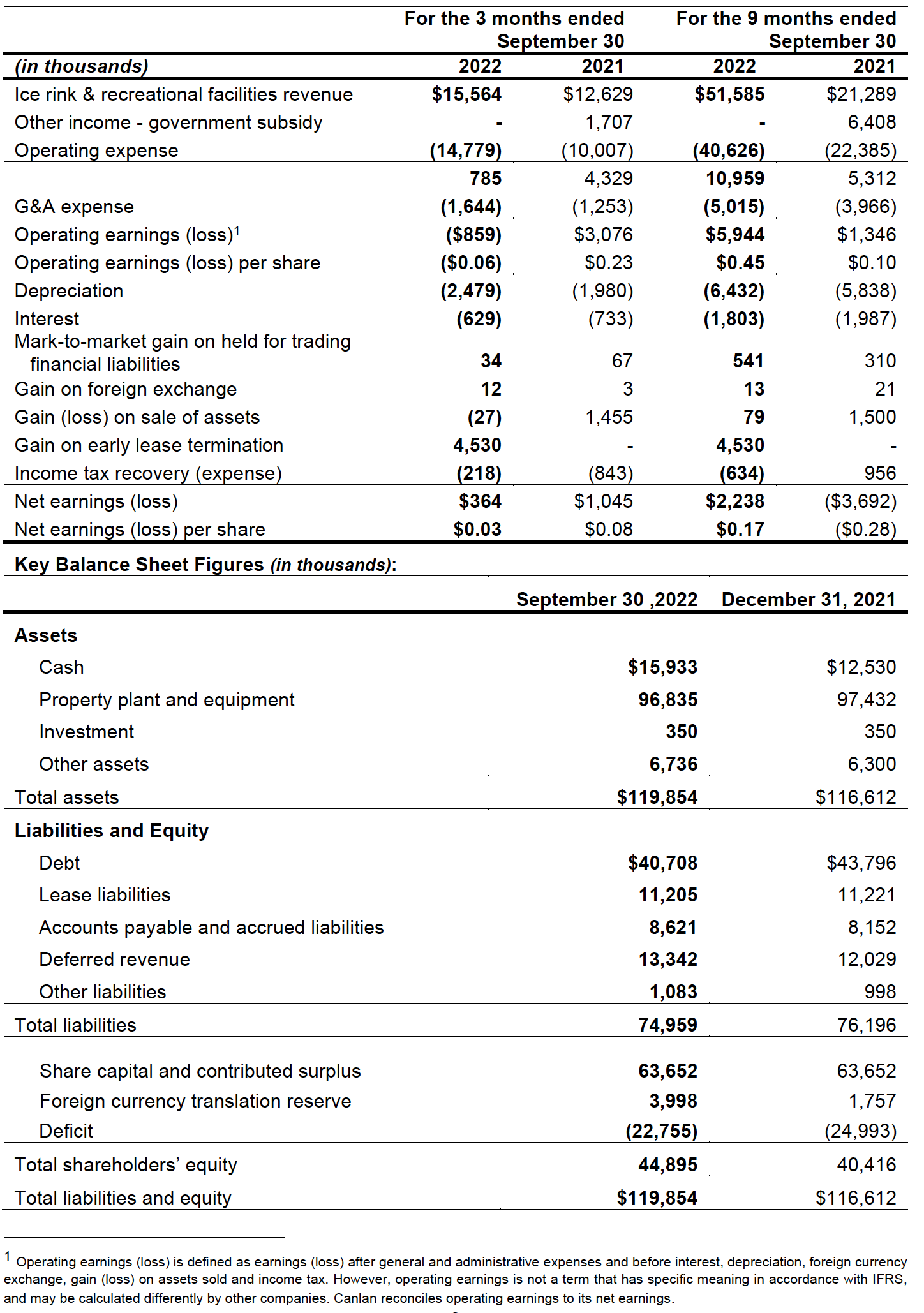

- Total operating revenue of $15.6 million increased by $2.9 million or 23% compared a

year ago; - Q3 same-facility surface revenue reached approximately 90% of pre-pandemic (Q3

2019) levels; - Total operating loss was $0.9 million compared to operating earnings of $1.4 million in

2021; however, the prior year had the advantage of $6.4 million of government

subsidies. In 2022, operating expenses also increased as facilities completed a number

of maintenance projects that had been deferred from the prior year, most notably, large

roof remediation projects that totaled $1.3 million plus $0.4 million of building renovation

upgrades at specific locations; - Team registrations of the fall/winter Adult Safe Hockey League season returned to 98%

of pre-pandemic levels; - Given the return to full operations and the Company’s relatively strong liquidity position,

Canlan’s Board of Directors has approved the resumption of the Corporation’s quarterly

dividend distribution and has set the quarterly dividend amount at $0.03 a share, up

from $0.0275 a share; - Canlan received cash consideration of $4.5 million in September 2022 to surrender its

lessee position of a sports complex lease prior to the maturity date of the lease

agreement; and - The Company continued to make important progress in reducing its carbon foot-print

while also improving facility indoor air quality by investing in new electric ice resurfacers,

roof replacement initiatives, and enhanced refrigeration automation systems.

Three Months and Nine Months Ended September 30, 2022 Results

Third Quarter Results

(three months ended September 30, 2022 compared with three months ended September 30, 2021)

- Total operating revenue of $15.6 million increased by $2.9 million or 23% compared to

2021 as operations returned to 100% capacity in 2022; - Total operating expenses of $14.8 million increased by $4.8 million or 47.7% due to the

return to full operations in 2022 and the completion of significant maintenance projects,

some of which were deferred from the previous two years (including roof remediation); - Total G&A expenses of $1.6 million increased by $0.4 million or 31.2% mainly due to

the centralization of our product and customer support team members; - Loss from operations was $0.9 million compared to operating earnings of $3.1 million in

Q3 2021. Included in prior year’s operations earnings was $1.7 million of income from

government subsidies; - During the quarter, a gain on early lease termination of $4.5 million was recognized as

Canlan received cash consideration of $4.5 million to surrender its lessee position of a

sports-complex-lease prior to the maturity date and extension-option of the lease

agreement; and - After recording $3.3 million related to depreciation, finance costs, income tax expense

and other miscellaneous items, net earnings for the period was $0.4 million or $0.03 a

share compared to $1.0 million or $0.08 a share in 2021.

Nine Months Ended September 30, 2022 Results

(nine months ended September 30, 2022 compared with nine months ended September 30, 2021)

- Total revenue was $51.6 million compared to $27.7 million in 2021 as operations were

at full capacity starting February 2022 compared to 2021, when facility closures were

still in effect until the latter weeks of Q2; - Adult-Safe Hockey League (ASHL) revenue for the first nine months of 2022 reached

approximately 93% of 2019 levels (pre-pandemic year) on a same-facility basis,

demonstrating the continued strength of the Company’s adult hockey league offering; - Total operating expenses of $40.6 million increased by $18.2 million due to the full

resumption of operations in 2022 and the completion of key maintenance projects to

enhance facility dressing rooms, weather-proof building envelopes and maintain

equipment in accordance with our repair and maintenance schedules; - G&A expenses of $5.0 million increased by $1.0 million or 26.4% mainly due to the

centralization of our product and customer support team members and resumption of

normal office activities of corporate staff and board members (e.g. collaboration

meetings, travel, training, recognition, etc); - Operating earnings before interest, depreciation and taxes was $5.9 million compared

to $1.3 million in 2021; and - After recording a gain on early lease termination of $4.5 million plus expenses of $8.2

million related to depreciation, finance costs, income tax, and miscellaneous items, net

earnings for the period was $2.2 million or $0.17 a share, compared to a net loss of

$3.7 million or $0.28 a share a year ago.

“After the first three quarters of 2022, we’ve finally completed a full spring/summer season

without interruptions for the first time in three years,” said Joey St-Aubin, Canlan’s CEO.

“While the return of player participation in our youth hockey leagues and instructional programs

have been more gradual, revenue from surface rentals, our ASHL, and our in-house

tournaments has surged back to levels comparable to 2019. I’d like to congratulate the entire

team in all locations for this achievement and I also want to thank our customers for their continued patronage. We’re also starting to gain traction in our food and beverage operations

as our recruitment programs, which have experienced significant challenges, have started to

gain success in providing facilities with the critical labour required to service food and beverage

operations at all of our locations.”

“During Q3, a significant number of projects were completed in various sports complexes to

enhance dressing rooms and playing surfaces, continue our roof remediation program to

proactively protect against adverse weather conditions, and continue to drive initiatives to

further our efforts to reduce carbon emissions and improve the air quality inside our sports

complexes,” added Canlan’s CFO, Ivan Wu. “In addition, with our ability to return operations

back to volumes comparable to pre-pandemic levels and our relatively strong balance sheet,

Canlan’s board of directors is excited to not only reinstate, but also increase the Company’s

quarterly dividend distribution. The new quarterly dividend rate has been set at $0.03 per

share, which represents a 9% increase compared to pre-pandemic distributions. Canlan’s

board and management greatly appreciate the support and patience of our shareholders during

the past 30 months.”

Dividend Policy

When the COVID-19 pandemic began, measures were implemented by management to

preserve cash balances. Given this, combined with the austerity that was asked of our

employees, directors, our customers, our suppliers and our financial partners, Canlan’s Board

of Directors suspended the payment of dividends on March 24, 2020. Given the return of full

operations and the Company’s relatively strong liquidity position, Canlan’s Board of Directors

has approved the resumption of the Corporation’s quarterly dividend distribution. As such, the

Board declares eligible dividends totaling $0.03 per common share that will next be paid on

January 16, 2023 to shareholders of record at the close of business December 29, 2022.

Canlan’s Board of Directors reviews the Corporation’s dividend policy on a quarterly basis.

Filings

Canlan’s financial statements and Management’s Discussion & Analysis for the period ended

September 30, 2022 will be available via SEDAR on or before November 14, 2022 and through

the Company’s website, www.canlansports.com.

About Canlan

Canlan Ice Sports Corp. is the North American leader in the development, operations and

ownership of multi-purpose recreation and entertainment facilities. We are amongst the largest

private sector owners and operators of recreation facilities in North America and currently own,

lease and/or manage 17 facilities in Canada and the United States with 49 ice surfaces, as well

as five indoor soccer fields, and 20 sport, volleyball, and basketball courts. To learn more

about Canlan please visit www.canlansports.com.

Canlan Ice Sports Corp. is listed on the Toronto Stock Exchange under the symbol “ICE.”

Caution concerning forward-looking statements

Certain statements in this News Release may constitute ”forward looking” statements which

involve known and unknown risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Corporation to be materially different from any

future results, performance or achievements expressed or implied by such forward looking

statements. When used in this News Release, such statements may use such words as ”may”,

”will”, ”expect”, ”believe”, ”plan” and other similar terminology. These statements reflect

management’s current expectations regarding future events and operating performance and

speak only as of the date of this News Release. These forward looking statements involve a

number of risks and uncertainties. Some of the factors that could cause actual results to differ

materially from those expressed in or underlying such forward looking statements are the

effects of, as well as changes in: international, national and local business and economic

conditions; political or economic instability in the Corporation’s markets; competition; legislation

and governmental regulation; and accounting policies and practices. The foregoing list of

factors is not exhaustive.

For more information:

Canlan Ice Sports Corp.

Ivan Wu

CFO

604 736 9152